June 2017 was a whirlwind in Nashville, a city buzzing with nonstop excitement. The Country…

I think I’m ready for EMV

What is available for Chipped-Card Readers today?

Making the change to accept EMV*-enabled payment cards requires a few decisions on the front end. HCS wanted to send out another communication to let you know what is available today, April of 2017, for your restaurant environment on Aloha POS.

In the Non-Tipped Counter-Service restaurant environment, EMV devices are separate machines that are tethered to the POS terminal, and face the consumer. You’ve seen these devices in everything from the grocery store to dry cleaners and convenience stores for years. You have probably seen many of these places that have modern machines, but have a sign that says “No Chip” or “Slide Only”. Why would they do that? Here are some reasons why some establishments, including many National Fast-Food brands have delayed the adoption of EMV.

In the Non-Tipped Counter-Service restaurant environment, EMV devices are separate machines that are tethered to the POS terminal, and face the consumer. You’ve seen these devices in everything from the grocery store to dry cleaners and convenience stores for years. You have probably seen many of these places that have modern machines, but have a sign that says “No Chip” or “Slide Only”. Why would they do that? Here are some reasons why some establishments, including many National Fast-Food brands have delayed the adoption of EMV.

Still, there are compelling reasons for some counter-service establishments to move ahead now rather than wait for advances in speed and reduction of costs. For those merchants, Aloha has the following combination of devices and Payment Processors available today.

If you are a Table Service restaurant you should know that sometime in the next 24-36 months, U.S. Card-Issuing banks will transition once again, this

If you are a Table Service restaurant you should know that sometime in the next 24-36 months, U.S. Card-Issuing banks will transition once again, this

time from Chip-&-Signature to Chip-&-PIN. At that time, cards will remain in the consumers’ hands. That means you will need to take a payment device to their table. Doing this requires much more than just obtaining a wireless device. Complete, solid Wi-Fi coverage, using the latest in Managed Firewall technology cannot be obtained by hooking up a router you bought at Staples or Office Depot, etc. You would endanger your business if you tried

to do this with consumer-grade appliances. Plan carefully, and get your Aloha representative in the conversation now to help. Do you want or need EMV chip readers attached to your existing POS terminals now, only to also buy wireless ones after you’ve invested in the right infrastructure for that? Maybe, but likely not. Plan twice; buy once if you can. More options come to market every month or two now.

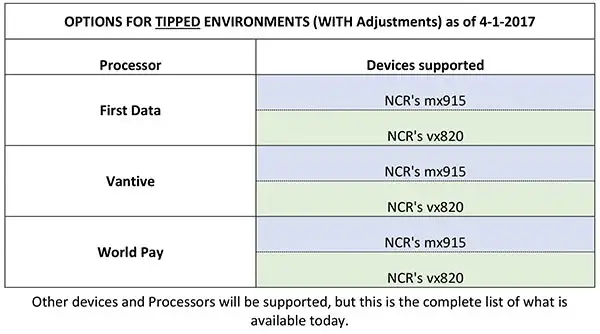

For those customers of ours that need or want EMV-enabled devices now, a list of processors and equipment is below. Keep in mind that at present, these are all tethered machines, meaning that they are connected physically to the POS terminals. Within the 2nd Quarter of 2017, a wireless payment device will be available. Again, wireless payments require a much more secure wireless network with a commercial-grade, managed firewall.

*EMV stands for Europay, Mastercard, Visa, (Even though American Express and others are also included) and basically refers to payment cards that have an embedded chip. These are also sometimes referred to as “Chip and Signature” or “Chip and PIN” cards.