June 2017 was a whirlwind in Nashville, a city buzzing with nonstop excitement. The Country…

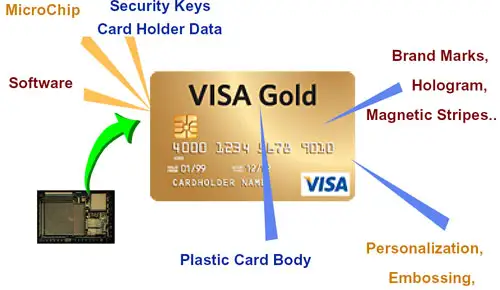

EMV Payments Technology and What that Means

Listed below is the initial information that has been circulated by the Payments industry to help you begin to understand the upcoming changes as the United States moves toward new payment types. We will update this information as more becomes available to us regarding the acceptance of Chip-enabled cards and your Aloha POS system.

We can help with that

There are Competing Payment Options: Unlike in Europe and Canada when they switched to chip-enabled cards, today there are Apple Pay, Google Wallet, and other Near-Field-Communication (NFC) payment options that are competing for dominance in the payment world. These will also require a specific functionality of hardware payment terminals. Some merchants would like to have payment terminals that are multi-functional so that they can take all of these payment types with a single device. Development of these multi-functional terminals is proceeding at a rapid rate, and we want to make sure that we are bringing all available options to our customers before we present them for sale.

Finally: And perhaps most importantly, Point-To-Point-Encryption (P2PE) is technology that makes it exponentially more difficult for criminal hackers to breach the merchant’s payment environment in the place of business and obtain card-holder data. It is important to all of us that P2PE be present in all new payment devices. NCR and HCS are aware that our restaurant merchants have more potential threat from criminal hacking than from the use of fraudulent cards (obtained from hacking other merchants) in our customers’ businesses. Thus, we’re seeking the payment devices that contain P2PE technology, no matter what new payment type they are designed to accept.